After being accepted into Tim Sykes’ Millionaire Challenge in late May, I spent the entire summer and fall of 2013 studying videos, DVDs, and attending lectures. Below was my daily schedule:

4:45am PST: Alarm

5:00am PST – 6:00am PST: Study video and review pre-market watchlists

6:00am PST – 6:30am PST: Check pre-market movers, review charts, prepare orders with multiple entries & exits

6:30am PST – 8:00am PST: Trade

8:00am PST – 11:00am PST: Sleep or attend lectures

11:00am PST – 1:00pm PST: Trade

1:00pm PST – 2:00pm PST: Eat lunch

2:00pm PST – 7:00pm PST: Study video

7:00pm PST – 8:00pm PST: Eat dinner

8:00pm PST – 12:00am PST: Study video

As you can see from the above, my entire life became consumed with stocks. I would review video almost non-stop — even while cooking, bathing, going to the bathroom, I would have a video running on my computer, phone or iPad. While driving around the city, I had my phone or iPad open playing video from Profitly. Even if I couldn’t see the visuals, I would listen to Tim’s commentary and visualize the chart patterns he was describing. During the trading day I would have two laptops open: one running trading software and the other running a dvd or video. Tim Sykes pervaded every minute of my life, 19 hours a day, for months on end.

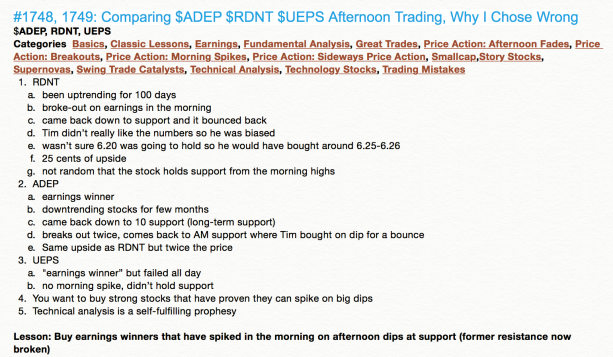

I took notes on each and every video, including the title of the video, the tickers mentioned, keywords, a bullet pointed list of lessons, and a summary of the main takeaways. I ended up compiling a document, hundreds of pages long, with hyperlinks to each video. I included keywords in case I wanted to search for a topic like “earnings winners” — I could easily find all the videos with that tag, should I need to review a specific topic. I also starred what I deemed were the best videos, in order to skip straight to the best content and make review easier. An example below:

As you can see I bolded the main takeaway lessons so that I could quickly scroll through and review should I ever feel in a rut. Each time I would fly back to the East Coast, I would spend the entire 5 hour flight scrolling through my notes, and re-watching any videos I needed to review. This proved extremely valuable to my learning process. I have these notes backed up in at least 4 different locations — on multiple servers, hard-drives, and even physical copies.

Note-taking aside, I made a lot of mistakes that summer, although looking back I’m not sure if it was a natural part of the learning process, or just my being too impatient and eager for action (probably both). I ended up trading stocks & patterns I had no business trading, particularly early-on, before I had a chance to really absorb all of the video lessons. I gradually honed my focus as the months wore-on, and it wasn’t until October or November, after PSC13, before I was really in my element.

It’s really funny looking back because now I have such a tight, controlled system of scanning and selecting stocks. I’m at the point now where I can open my software, spend just a few minutes looking at tickers, and pretty much know then and there if I am going to have any trades that day. Back then though, I felt like I was all over the place. My focus was being stretched in all different directions, and I felt like I was always behind the ball, that I was always struggling to keep up. It’s not that I couldn’t make sense of all the information that I was being fed, rather I wasn’t able to form a cohesive narrative about what I should be trading, when, and how. That all came together gradually through watching videos, attending lectures, and probably most importantly, through trading experience.

I view those early failure as the price of tuition in learning how to trade. I will give myself credit for one thing though — I documented EVERY chart that I traded, taking screenshots and enumerating exactly what I did wrong, and what I should have done instead. An example of an earnings winner that faked me out is below:

I used these screenshots to analyze everything I did right and wrong in an attempt to improve my winning % and pick better stocks. I even went as far as compiling a folder of “avoided trades” and “missed trades”, in order to document why I didn’t take a certain trade that I was considering. An example of an avoided short trade below:

I was considering taking a short position on the above stock (note: not a stock or chart that I would short today), but avoided due to the fact that it was “short-squeeze Friday”. I would have been squeezed hard here — I also noted that flipping sides and buying the squeeze would have been a decent trade plan.

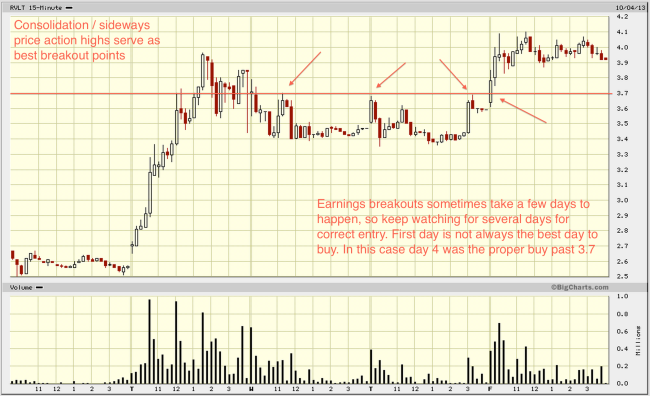

I also took screenshots of the various charts that Tim taught and I enumerated exactly what Tim did right and wrong, per his commentary. I saved these charts in a folder called “Charts to Memorize”, and “Tim Lessons” and further organized the charts by long/short and then by category/pattern name. I have dozens of folders with various pattern titles such as “the trap”, “long stair-stepper”, “short stair-stepper”, “afternoon fade”, “morning panic”, “mid-day spike after morning panic”, “afternoon fake-out breakout”, “cover when support holds”, “dip buy”, “pump dip buy”, “AM spike”….to name a few. I would cycle through these charts like flashcards, burning each pattern into my brain. I also listed in what video each pattern appeared, in case I wanted to go back and review the original video. An example from one of Tim’s dip buy video lessons below:

Another example below, this one from one of Tim’s video lessons on shorting:

I used these screenshots to internalize the lessons and memorize the chart patterns. Below is an example from one of my folders titled “delayed earnings breakouts”.

I became obsessed with knowing all of the potential ways a stock trade could possibly play out. I would go into a trade with a handful of trade options in my mind — for example I would anticipate that an earnings winner holding near its highs into close could either spike into close, hold it’s gains but not spike, dip due to profit taking, spike the next morning, delay spike the next morning, gap the next morning, sell-off the next morning, or delay breakout a few days later. I had every trade option memorized and was prepared to take action accordingly.

I continued to make mistakes, however by August they were getting less frequent and less sizable. Another thing I did, which is a MUST if trading, is that I kept a spreadsheet (trade log) of every trade I made with the date traded, ticker, long/short, entry price, exit price, position size, $/share gain/loss, $ gain/loss, % gain/loss, commission, $ profit/loss after commission, fundamentals, technicals, exchange, reason why traded, where I found the stock, and notes. An example from my trade log below:

I also kept analytics, breaking down my trades by pattern, long/short, month, exchange, time of day, and fundamentals, so that I was able to keep tabs on, and analyze exactly what was working and what was not. For example I could look at my trades in any given month and see that I was 100% profitable on late-afternoon earnings breakouts (my bread and butter), while I was 0% buying breakouts in the early-afternoon. I suppose it became somewhat of a self-fulfilling prophesy as I would focus on what worked, and shied away from what didn’t, but I’m not too concerned as I was able to narrow down a niche.

Anyway…keeping militant records and notes is certainly what I would recommend, especially when you are just starting out. It is of the utmost importance to figure out what is working and what is not working, and adjust your trading style accordingly. I figured out what was working (namely late afternoon breakouts on earnings/contract winners, OTC gappers, and dip buying recent runners at support), and began to focus my attention on perfecting those categories. Whatever your strategy or whomever your guru may be, go all-out in your commitment as a student.

Blake,

I really enjoyed reading up on your trading journey. I have been Tim’s Challenge student since October 2014 and have taken the exact steps towards my education as you have described above. I must admit, since I started making a detailed trade plan and logging all of my trades on a spreadsheet my performance has improved dramatically as I am able to distinguish quickly what works and what does not. Even though I am trading small at the moment only 200-300 shares, my trades have become consistently profitable, when as before I was making mistakes left and right and had no record of understanding clearly on what I did wrong. I am very excited to continue on this path of, studying aggressively ever day, attending challenge classes, continue logging my trades to distinguish and understand winning trades, and continue pursuing my dream of becoming penny stocks day trader.

Thank you again for this blog, I feel like am on the right track to my success. I will update you later this year on how I am doing.

Drinkman

LikeLike